صنعت زیرساخت در ایران- سه ماهه اول 2014

BMI Industry View

BMI

View: We currently maintain a short-term

bearish outlook for the Iranian construction sector. Although official data has

not yet been published, we estimate a contraction in the industry in both 2012

and 2013 at 1.6% and 1.0% respectively. This is the result of a challenging

macroeconomic picture, international sanctions and a prohibitive business

environment. We are, however, more optimistic over the medium-to-longer term as

an improvement in economic conditions should bring some respite for the sector.

As such, we expect moderate growth to return in 2014 at an estimated 1% in real

terms and an average of 3.5% between 2015 and 2022.

The Islamic Republic remains a country of pronounced risks, including political instability, economic stagnation and social tensions, and we believe the current situation is unsustainable over the long run. Despite a spike in oil prices, the latest wave of US energy sanctions and the EU oil embargo, coupled with a ban on London-issued insurance on oil tankers, has taken its toll on Iranian oil production, and consequently the economy at large. With its main avenue for earning foreign currency - oil represents half of the Iranian government's revenues, and accounts for an estimated 53% of the country's total exports - more or less depleted the government will be forced to cut back further on public spending.

Key developments in the industry:

A challenging macroeconomic backdrop will continue to weaken

the outlook for Iran's construction sector over the coming quarters. Elevated

inflation will also weigh on real industry growth - BMI forecasts

inflation to average 35% year-on-year (y-o-y) in FY2013/14 - due to a weakening

currency. The Central Bank undertook a de facto devaluation of the rial in July

2013 from IRR12,260/US$ to IRR24,779/US$. This will also have an adverse effect

on the availability and cost of imported capital goods, exerting yet more

pressure on company profit margins.

Oil revenues account for a significant chunk of government income, estimated at

55% of total revenues in FY2011/2012. This percentage is expected to fall as a

result of international sanctions and this will have an adverse impact on

public spending on infrastructure.

In terms of Teheran's nuclear programme, the latest developments point to a

notable improvement in relations between Iran and the West. At the time of

writing, further talks between the parties were being held and there were high

expectations for a negotiated solution to move forward.

With the exception of Russia and China, foreign interest in Iran's construction

sector will remain limited, while constrained government finances, persistent

project implementation issues and sluggish activity in the oil and gas sector

will continue to constrain growth in industry value.

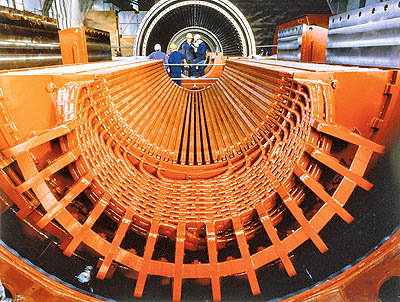

We have seen progress on the US$450mn Iran to Iraq gas transmission pipeline.

Completion was scheduled for July 2013 but the section in Iraq was delayed as a

result of the unstable security situation and property issues. Despite

political pressure from the US and the current sanctions imposed on Iran, we

expect the project to be operational soon.

In terms of maritime infrastructure, the Caspian Sea ports of Anzali and

Amirabad, located in the north of Iran, are to undergo major capacity upgrades

to double both their loading and unloading capabilities, according to the Head

of the Iranian Ports and Maritime Organization (PMO), Ata'ollah Sadr. The port

of Anzali will increase its cargo-handling capacity from 8mn tonnes per year to

16mn tonnes. Amirabad, which is already Iran's largest Caspian Sea port, will

go from a 5mn tonnes capacity to 10mn.

گزارش تحلیلی بیزینس مانیتور- صنعت زیرساخت در ایران- سه ماهه اول 2014